For entrepreneurs seeking funding to launch or scale their businesses, understanding the difference between angel investors and venture capitalists is crucial. While both provide capital to startups, their approaches, expectations, and investment strategies differ significantly. This guide breaks down the key distinctions to help founders determine which funding source might be right for their business stage and goals.

Investment Size and Stage

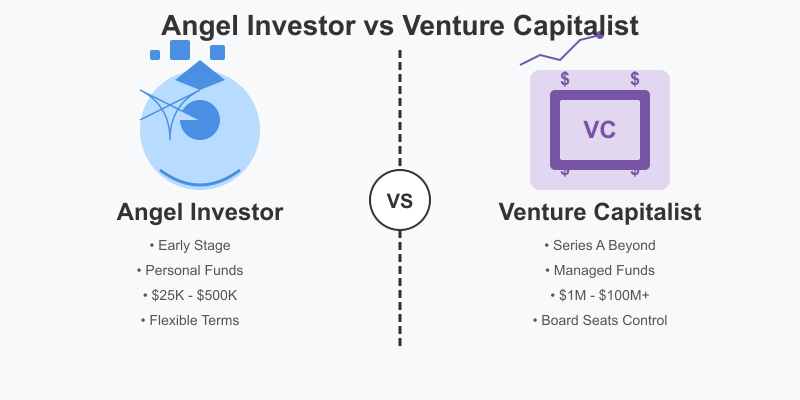

Angel Investors typically enter the startup funding scene at the earliest stages. They provide what’s often called “seed capital” – the initial money needed to move from concept to viable product. Angel investments generally range from $25,000 to $100,000, though some may invest up to $500,000 in exceptional cases.

Venture Capitalists tend to enter the picture later, usually at Series A funding rounds and beyond. They invest significantly larger amounts, commonly starting at $1 million and potentially reaching tens or even hundreds of millions in later funding stages. VCs rarely participate in pre-seed or seed rounds unless the founder has an exceptional track record or the startup shows extraordinary promise.

Source of Funds

Angel Investors invest their personal assets. These individuals are typically high-net-worth persons who have accumulated wealth through successful business ventures or high-paying careers. Their investment decisions are made independently, based on personal judgment and interests.

Venture Capitalists manage pooled money from limited partners, which may include pension funds, endowments, insurance companies, and wealthy individuals. They serve as professional fund managers with a fiduciary responsibility to generate returns for their investors. This means VCs must justify their investment decisions to their limited partners.

Decision-Making Process

Angel Investors make relatively quick decisions, often based on personal connection with the founders or passion for the business concept. The due diligence process is typically less rigorous, and funding can sometimes be secured within weeks.

Venture Capitalists employ a structured, methodical approach to evaluating potential investments. Their due diligence process is comprehensive, including market analysis, competitive assessments, technical evaluations, and detailed financial projections. This process commonly takes 3-6 months from initial pitch to funding.

Involvement Level

Angel Investors vary widely in their level of involvement. Some prefer a hands-off approach, while others actively mentor founders, leveraging their expertise and networks. Their involvement is typically more informal and relationship-based rather than contractually defined.

Venture Capitalists almost always take an active role in companies they fund. This usually includes a seat on the board of directors, regular performance reviews, and strategic guidance. Their involvement is formalized through investor agreements and focuses on accelerating growth and preparing for subsequent funding rounds or exit events.

Return Expectations

Angel Investors understand the high-risk nature of early-stage investments and may be more patient regarding returns. While they certainly expect profits, many are also motivated by the desire to support innovation in areas they’re passionate about or to mentor the next generation of entrepreneurs.

Venture Capitalists have strict return targets that typically aim for a 10x return on investment within 5-7 years. Their fund structure and obligations to limited partners necessitate these aggressive growth expectations, which influences the types of startups they invest in and their growth strategies.

Equity and Control

Angel Investors typically take a minority equity stake (usually 5-25%) and rarely demand control provisions. Their terms are often more founder-friendly and flexible.

Venture Capitalists generally acquire larger equity portions and incorporate more stringent terms, including liquidation preferences, anti-dilution protections, and board seats. They may push for specific growth milestones and maintain significant influence over major business decisions.

Risk Appetite

Angel Investors can afford to take chances on unproven concepts or founders without extensive track records. They often invest based on the potential they see in the entrepreneur or the innovative nature of the solution.

Venture Capitalists must demonstrate sound investment judgment to their limited partners, which typically leads to more risk-averse behavior. They generally prefer startups that have already demonstrated product-market fit and show clear paths to scalability.

Which Is Right For Your Startup?

The ideal funding source depends largely on your startup’s stage and needs:

- Consider Angel Investment if you’re in the early concept or development phase, need smaller amounts of capital, value flexibility in terms, and would benefit from mentorship from successful entrepreneurs.

- Pursue Venture Capital when you’ve validated your business model, need substantial capital to scale rapidly, can demonstrate significant market opportunity, and are prepared for the accountability and growth expectations that come with institutional funding.

Many successful startups begin with angel funding and graduate to venture capital as they grow. Understanding the distinct roles these investors play in the startup ecosystem can help founders craft appropriate funding strategies for each stage of their business journey.

Remember that regardless of which path you choose, investors are looking for passionate founders solving meaningful problems with scalable solutions. Prepare accordingly, and you’ll be well-positioned to secure the funding your venture needs to thrive.

This blog post is for informational purposes only and does not constitute financial or investment advice. Always conduct thorough research and consider consulting with professional advisors before making investment or funding decisions.