Life is full of mistakes. Even with the best of intentions, it’s easy to make financial mishaps. But it’s not just about the mistakes you’re making — it’s the opportunities you could be missing. The good news is it’s never too late to recover from these mistakes, and it’s never too soon to learn how to avoid them! Let’s look at the most common financial mistakes to avoid and how to steer away from them.

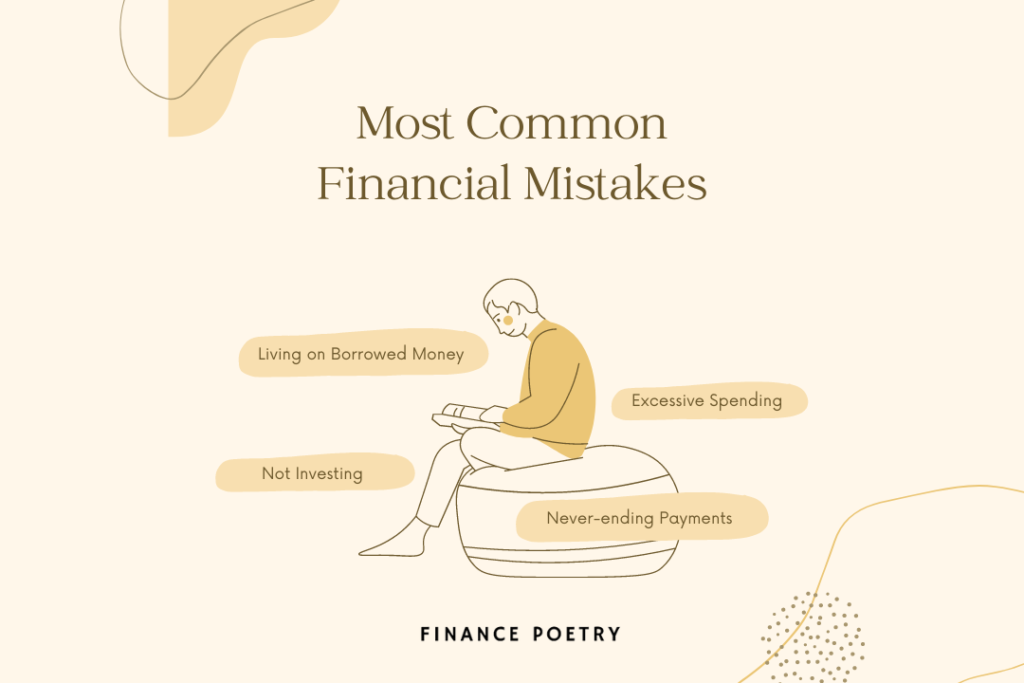

Here are the top 10 most common financial mistakes that people make:

Not saving enough for retirement: It is important to start saving for retirement as early as possible, as this will give your money more time to grow.

Not having an emergency fund: Unexpected expenses can arise at any time, and having an emergency fund can help you weather these financial storms.

Carrying high-interest debt: High-interest debt, such as credit card debt, can be financially debilitating. It is important to pay off high-interest debt as soon as possible.

Not having a budget: A budget can help you track your spending and ensure that you are living within your means.

Not investing in your education: Investing in your education can pay off in the long run, as it can lead to higher paying job opportunities.

Not diversifying your investments: Diversifying your investments can help spread risk and increase your chances of earning a positive return.

Not having insurance: Insurance can protect you against unexpected financial losses, such as those resulting from accidents or natural disasters.

Not negotiating salary or benefits: Negotiating salary and benefits can help you earn more money and receive better perks, such as retirement contributions or health insurance.

Not keeping track of your credit score: Your credit score can affect your ability to get loans, credit cards, and even apartments. It is important to keep track of your credit score and work to improve it.

Not planning for the future: It is important to have a financial plan in place that accounts for your short-term and long-term goals. This can help you make informed financial decisions and stay on track to achieve your objectives.