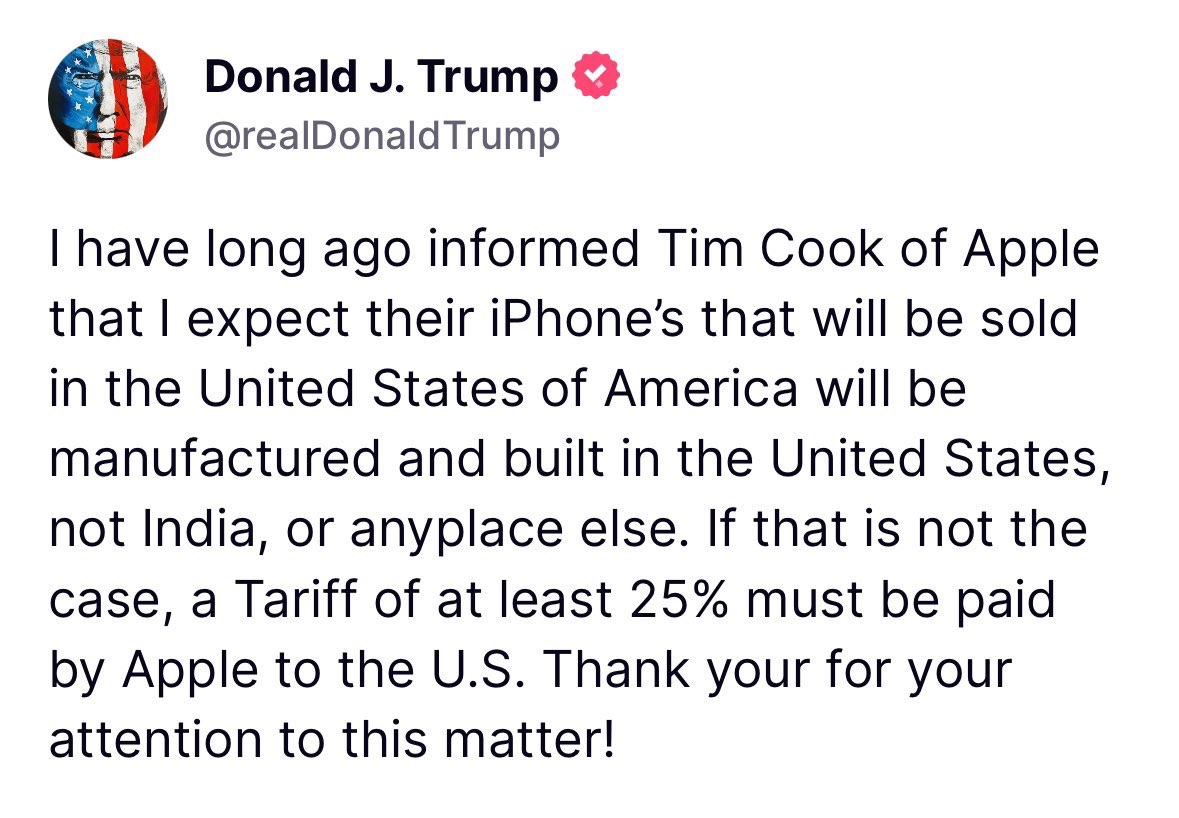

In a bold move, US President Donald Trump has threatened to impose a 25% tariff on Apple if the tech giant continues manufacturing iPhones outside the United States, specifically calling out India and other countries. This statement has sparked widespread debate about trade policies, global supply chains, and the implications for one of the world’s most valuable companies. Is this a strategic push to bring manufacturing back to the US, or a risky gamble that could disrupt the global economy? Let’s dive into the details.

The Context of Trump’s Threat

President Trump’s remarks come amid his ongoing push for “America First” policies, emphasizing domestic manufacturing to boost jobs and economic growth. Apple, which relies heavily on overseas production—particularly in India and China—has been a frequent target of such rhetoric. The company has diversified its supply chain in recent years, with India emerging as a key manufacturing hub due to cost advantages and government incentives. Trump’s proposed 25% tariff aims to pressure Apple into relocating production to the US, but the feasibility and consequences of such a move are far from straightforward.

Why India?

India has become a critical part of Apple’s supply chain, with companies like Foxconn and Pegatron setting up massive facilities to produce iPhones. The Indian government’s Production-Linked Incentive (PLI) scheme has incentivized tech giants to expand manufacturing in the country, creating jobs and reducing reliance on China. Trump’s threat specifically targeting India signals a broader intent to curb offshoring, but it overlooks the complexities of global trade and the economic benefits of diversified manufacturing.

Potential Impacts on Apple

A 25% tariff on iPhones manufactured abroad would significantly increase costs for Apple, potentially forcing the company to either absorb the hit or pass it on to consumers. Given Apple’s premium pricing strategy, higher iPhone prices could dampen demand, especially in price-sensitive markets. Relocating production to the US, while aligning with Trump’s vision, would require massive investments in infrastructure, workforce training, and navigating higher labor costs—challenges that could take years to overcome.

Global Supply Chain Ripple Effects

Apple’s supply chain is a complex web spanning multiple countries, with components sourced globally and assembled in key hubs like India and China. A tariff-induced shift could disrupt this ecosystem, impacting suppliers, workers, and economies worldwide. India, for instance, has positioned itself as a manufacturing alternative to China, and a setback here could slow its economic momentum. Meanwhile, US consumers could face higher prices not just for iPhones but for other electronics caught in the crossfire of a potential trade war.

Political and Economic Implications

Trump’s threat aligns with his protectionist stance but risks escalating tensions with trading partners like India, which has been strengthening ties with the US. A tariff war could strain diplomatic relations and provoke retaliatory measures, further complicating global trade dynamics. Economists warn that such policies could lead to inflation, reduced consumer spending, and slower economic growth, echoing the mixed outcomes of Trump’s previous trade battles with China.

Apple’s Possible Response

Apple has several options to navigate this threat:

- Negotiate with the US government: Apple could leverage its economic influence to seek exemptions or phased compliance.

- Accelerate US manufacturing: Limited production in the US could be scaled up, though not without significant costs and delays.

- Diversify further: Apple might explore manufacturing in other countries to mitigate risks from tariffs.

- Pass costs to consumers: Price hikes could offset tariffs but risk alienating customers.

The company’s next moves will depend on the likelihood of Trump following through and the broader political climate.

Conclusion

President Trump’s threat to slap a 25% tariff on Apple for manufacturing iPhones abroad is a high-stakes play with far-reaching consequences. While it aims to boost US manufacturing, it risks disrupting global supply chains, raising prices, and straining international relations. For Apple, the challenge is balancing profitability with compliance in an increasingly volatile trade environment. As this story unfolds, the tech industry and consumers alike will be watching closely to see if this is a bluff or the start of a new trade war.