Financial freedom is the state of having sufficient personal wealth to live indefinitely without having to work actively for basic necessities. For many people, financial freedom is a dream that they work towards throughout their lives.

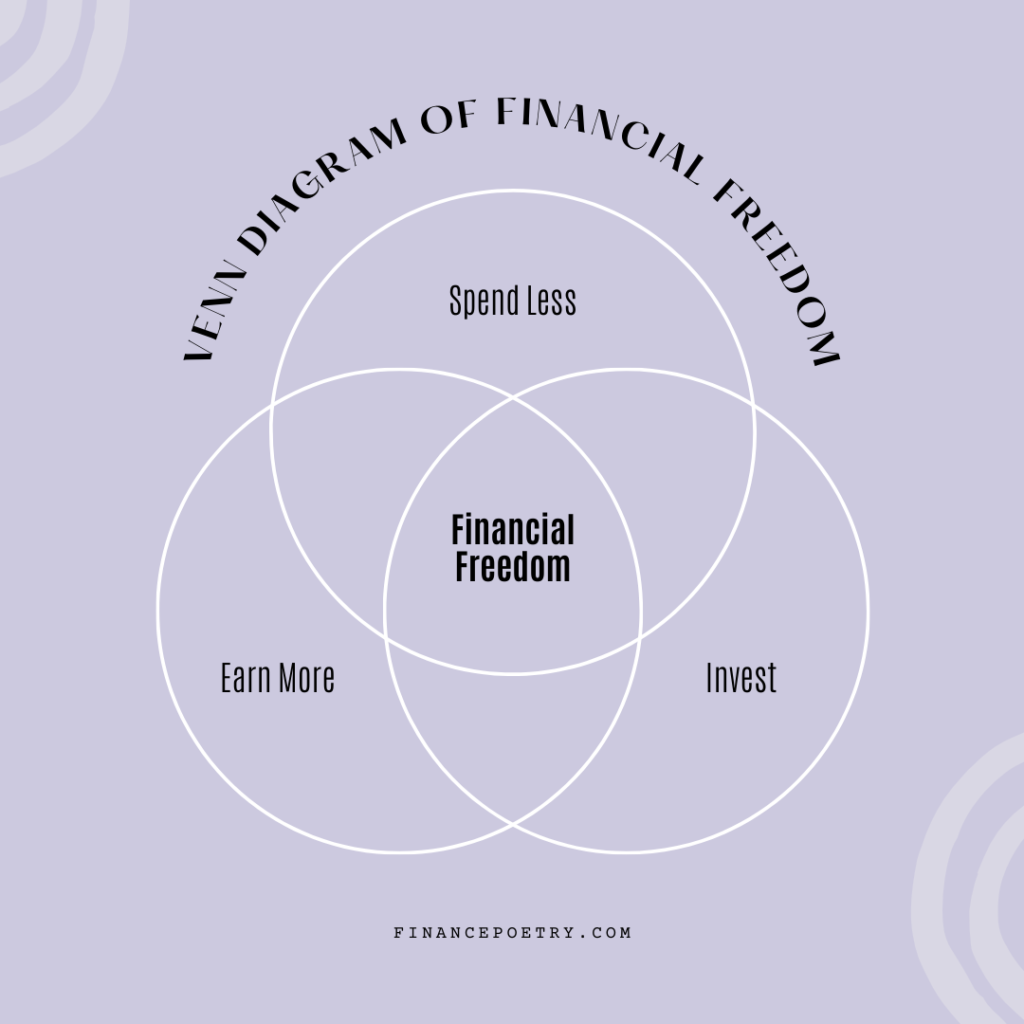

It is a state of financial independence that allows you to have control over your time and your financial decisions, and to live the life you want to live. To achieve financial freedom, you need to save and invest wisely, control your spending, and reduce your debt.

It may also require finding ways to increase your income and building a diverse investment portfolio that can provide a steady stream of passive income.

Financial freedom can be a long-term goal, but it is achievable with dedication and hard work.

Here are 10 habits that can help you reach financial freedom:

Create a budget and stick to it: A budget can help you track your spending and ensure that you are living within your means.

Save and invest wisely: It is important to save a portion of your income and invest it wisely in order to build wealth over time.

Pay off high-interest debt: High-interest debt, such as credit card debt, can be financially debilitating. It is important to pay off high-interest debt as soon as possible.

Educate yourself about personal finance: The more you know about personal finance, the better equipped you will be to make informed financial decisions.

Create multiple streams of income: Having multiple sources of income can help you achieve financial freedom more quickly.

Spend money wisely: Look for ways to save money on everyday expenses, such as by shopping around for the best prices or cutting unnecessary expenses.

Create a financial plan: A financial plan can help you set specific financial goals and track your progress towards achieving them.

Be patient: Building wealth and achieving financial freedom takes time. It is important to be patient and to stay focused on your long-term goals.

Surround yourself with like-minded individuals: Surrounding yourself with people who share similar financial values and goals can help you stay motivated and on track.

Stay disciplined: It takes discipline to stick to a budget, save money, and make smart financial decisions. It is important to stay focused and committed to your financial goals.

We will recommend a book Psychology of money Read book review

Timeless lessons on wealth, greed, and happiness doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people.

Click here to Buy Psychology of money

Disclaimer: Any/all of the links on financepoetry.com are affiliate links from with I receive a small commission from sales of certain items. As an Amazon Associate, I earn from qualifying purchases. Thank you!